2: Taboola and the open web rebels, Israeli Tech Review, Open space reserve in the middle of the city

Hello there! I don’t have anything to add on the ongoing Twitter-Musk and SBF-FTX stories, but here are a couple of things that I ran into last week:

Yahoo buys a 25% stake at Taboola, forming strategic partnership

This story stood out in between the headlines about tech layoffs in Israel. From TechCrunch:

Yahoo is taking a nearly 25% stake in advertising network Taboola. In exchange for this move, Taboola is becoming Yahoo’s native advertising partner through a 30-year commercial agreement.

The story of Taboola resembles the story of many other Israeli tech companies who went public (mostly via SPAC) at the height of the Covid internet boom. Taboola’s market cap peaked at $2.3B in November 2021, and dropped 84% by early November 2022. Much like many other Israeli “Covid winners turned zombie stocks”. The announcement of the Yahoo deal sent the stock soaring over 80% higher though.

It’s been an impressive journey for Adam Singolda, who founded Taboola in 2007 and has been CEO for the last 15 years. While “web content recommendation” has since became the core business of internet tech giants, he didn’t give up, and may have been able to carve a viable business for what Taboola calls “the open web recommendation platform” (“open”, unlike the walled gardens of Facebook, Google and Amazon).

If you’re not familiar with Taboola, you may have seen its content recommendation widgets on popular news websites, such as USA Today, Insider and The Weather Channel. They mostly feature sponsored links that lead to third-party websites. Those links appear in recommendation widgets at the end of news articles or in the middle of a content newsfeed.

This isn’t the first time Taboola is signing a strategic partnership that covers some of these properties. In 2015, Verizon acquired AOL. The next year, Taboola and AOL signed a strategic partnership that led to integrations of Taboola’s ads on AOL properties. Shortly after, Verizon also acquired Yahoo and merged AOL with Yahoo.

And now, the second incarnation of Yahoo, which includes AOL’s activities and operates separately from Verizon, is doubling down on digital advertising. With this new deal, Taboola becomes the exclusive partner for native advertising across all of Yahoo’s digital properties.

It means that you’ll soon scroll through news articles on Yahoo Finance and see an item that looks just like a normal article. But it will be a Taboola-powered advertising unit instead. Or at least, that’s the idea. Advertisers will be able to buy Taboola through the Yahoo DSP.

The Taboola story was presented as “arming the rebels” in the online advertising space. Their Jan 2021 investor presentation said “TABOOLA IS FOR ADVERTISING WHAT SHOPIFY IS FOR E-COMMERCE”. While they haven’t compared themselves to Shopify recently (the sentiment toward Shopify stock is not as positive as it was in 2021, to put it gently), Taboola still seem to be executing on the “arming the rebels” strategy.

Said “rebels” are likely be traditional news publishers like Bloomberg and CNBC, and web portals who fell short of their initial aspirations such as MSN, AOL, and now Yahoo. It remains to be seen how far the rebels could go using Taboola’s ammunition.

It’s worth mentioning OutBrain, another Israeli company with a very similar content recommendation platform, albeit of smaller scale (I previously mentioned their contribution to the Israeli software development ecosystem). While joining forces in “rebelling” against the internet giants seemed like an obvious move, Taboola and OutBrain called off their merger talks in September of 2020. Both went public as independent companies shortly thereafter, and the Taboola-Yahoo deal might leave OutBrain’s platform further behind.

Israeli Tech Review, October 2022

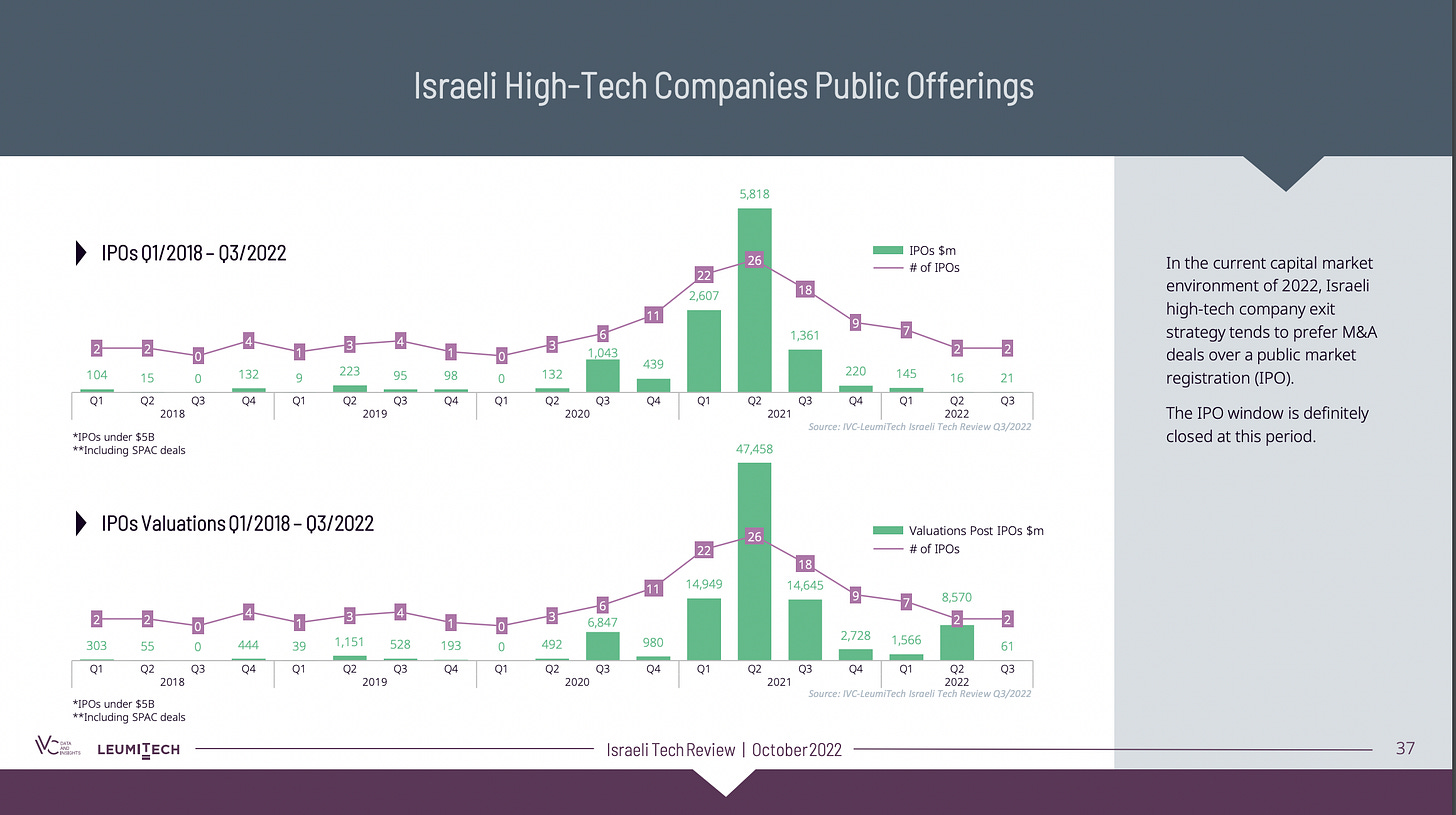

A couple of interesting anecdotes stood out in the latest report by IVC & Leumi Tech. While the investments and exits trends in Israeli tech are mostly in line with the overall global ecosystem - early rounds activity (seed & pre-seed) remains strong, a significant drop in mid to late rounds compared to 2021, and a completely closed IPO window - I found a couple of data points that reflect some characteristics that are unique to the Israeli tech industry.

The first is just how concentrated the Israeli tech industry has become in the area of cybersecurity - while the investments in this vertical (the pink bars on the chart below) were of similar magnitude to other verticals until 2017 or so, recent years saw a meteoric rise in the dollar amounts invested in Israeli cyber startups.

The origins of the Israeli cybersecurity expertise can be traced to the Israeli intelligence, as told by the Startup Nation Book: alumnus of these units have started companies such as publicly-traded Check Point, and Fraud Sciences which was acquired by PayPal.

These are older stories though. It feels like the more recent success of publicly traded Israeli companies like Palo-Alto Networks and Sentinel One, valued at tens of billions of dollars, has created a “cyber mania”. The expertise for building and selling software security products has spread across the Israeli ecosystem, as well as word about the high flying valuations and amounts of investor dollars chasing cybersecurity startups.

While the demand uptick was real - the accelerated post-Covid cloud adoption has created a wave of security concerns for a lot of companies - Israeli startups might have overdone it. The current economic slowdown could challenge the rapid growth of the Israeli cyber industry, and it’s unclear if that pink bar is going to keep its position far above the other startup sectors in 2023 and beyond.

Another interesting observation is that in the distant past, going public wasn’t the typical “Israeli startup dream”. Israeli founders used to have more humble dreams of being acquired by a large US company, and retiring after a few years of working as senior directors while their stock grant vests. They would often retire to start another company. This slide shows very little Israeli IPO’s taking place before 2020.

The pandemic internet boom allowed a wave of Israeli company to go public at extremely high valuations, among which Taboola that was mentioned in the previous section. This created a lot of internal tensions due to the rise in inequality, and some theories about how the SPAC phenomena is powering a dramatic rise in Tel Aviv real estate prices. I’ll leave it to another post.

The interesting question in my opinion is how long would it be before we see the next large Israeli IPO. The general tech IPO window will reopen at some point, and I imagine that companies like Stripe and Databricks will go public sooner or later. Israeli founders might continue to focus on more comfortable exits through M&A though, following the trauma and hardship that many Israeli public companies have been experiencing in the public markets in 2022. This is another case where I am curious to see how the graph shapes out over the next few years.

Personal Anecdote of the Week: Dresner Park

One of the things I liked most about San Francisco is the amount of beautiful open space reserves right in the middle of the city. You can make a turn from an urban SF street, walk a short path, and find yourself completely immersed in nature. We’ve made it a family tradition to spend our Saturday mornings exploring places like Glen Park Canyon or Mount Sutro, to name a few of our favorites.

Well, I’m happy to announce that we’ve found a place like that in Tel Aviv! Dresner Park is right on the edge of Ramat Aviv neighborhood (which some would argue is the Israeli version of Palo Alto). A short path between two buildings leads to a large reserve where you can leave the city behind you.

After a full night of rain the sun came out on Saturday morning, and we felt like it’s the kind of day that is best spent outside. The kids took advantage of the opportunity to splash some muddy paddles (though some parents weren’t as excited), and eventually found an awesome tree house. They decided to build a camp around it and told us that this is our new home.

They had such a good time exploring nature, that we only covered a small portion of the park. We’ll have to go back on another weekend, trying to make the most out of this nice time of year - the temperatures are in the 70’s now (23 degrees celsius) and mostly sunny.

Unlike the Bay Area, where you can enjoy hiking almost any day of the year, the hot and humid Israeli summer is very challenging, and it was impossible to spend too much time outside up until recently. The upside is that when it is nice outside, we don’t have to strategize around how to stay away from the fog (which was very hard to predict in the Bay Area). I wonder how long will I keep comparing the two places for.